Lidar maker Ouster delivered better-than-expected first-quarter sales And clear direction for the second quarter was provided. This pleased investors.

Thursday evening Ouster reported approximately $33 million in first-quarter sales. Analysts expected around $31 million based on FactSet data. This represents a 26% increase compared to the same period last year. Additionally, this marks the company’s ninth successive quarter of rising sales figures.

The firm anticipates revenues between $32 and $35 million for the next quarter. Analysts predict $33.6 million. The middle point of their forecast at $33.5 million suggests an increase of nearly 20% compared to the second quarter of 2024.

The shares increased by 22.8% on Friday, finishing at $10.62.

In the quarter, the adjusted EBITDA loss amounted to $8 million. EBITDA stands for earnings before interest, taxes, depreciation, and amortization. Analysts from Wall Street had predicted an EBITDA loss of $12 million.

Ouster has not reached profitability as of now. The company concluded the quarter with $171 million remaining in their accounts. According to projections from Wall Street, Ouster’s estimated cash usage for both 2025 and 2026 together would be around $95 million. Financial analysts anticipate that the firm will achieve positive full-year EBITDA by 2025.

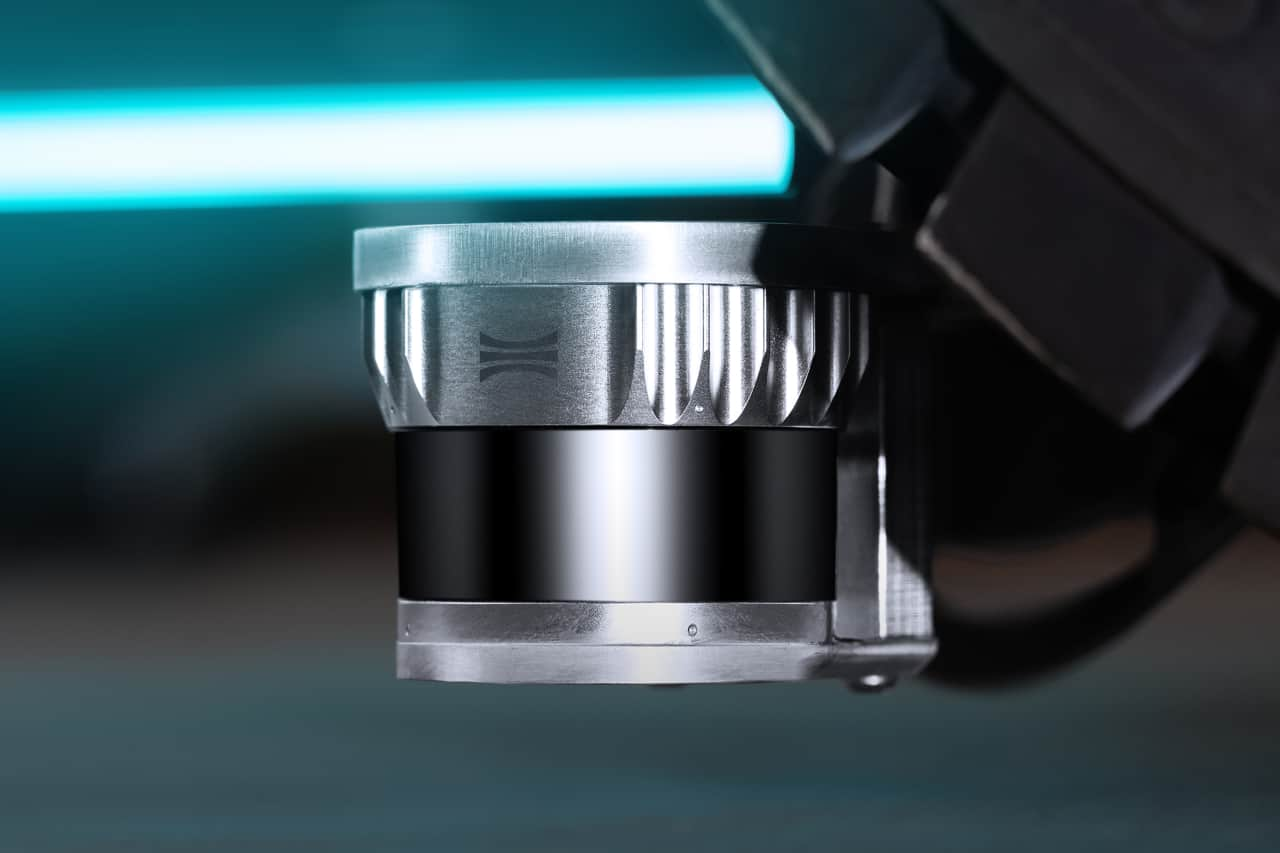

Lidar fundamentally operates using lasers similar to how radar works. This technology serves as the visual system for vehicles, machinery, and structures incorporating artificial intelligence to enhance daily living. According to CEO Angus Pacela, the market demand for intelligent infrastructures is currently quite robust.

Smart infrastructure can mean the inductive loops that know when a car pulls into a left turn lane so the traffic light knows to use the advanced left turn signal.

That technology can determine whether there is one or two vehicles prepared to make a left turn. "It doesn't gauge how many cars—say 20—are waiting in the left turn queue," explains Pacala. This type of solution, powered by lidar-enabled artificial intelligence, could greatly assist urban areas. "The advantage will be noticeable...with significantly reduced traffic jams...and implementing this tech would cost considerably less than excavating roads and installing sensors."

Drivers can embrace AI applications that result in reduced traffic jams and quicker left turns.

On Thursday, Ouster's stock price increased by 6.9% during normal trading hours, whereas the S&P 500 and the Dow Jones IndustrialAverage climbed by 0.58% and 0.62%, respectively.

President Donald Trump’s trade agreement with the U.K. seemed to boost numerous stocks as it offered a glimpse of relief from the tariff cloud.

Regarding Ouster, since they manufacture in Thailand, they have to deal with a 10% import tariff, which Pacala believes is manageable.

As of Thursday’s close, Ouster shares had dropped approximately 29% since the beginning of the year. Concerns over tariffs and broader economic conditions have dampened investors' moods.

Send the letter to Al Root at allen.root@dowjones.com

Posting Komentar

Posting Komentar