It's all centered around your data, which General Motors and others claim is essential for them to develop superior vehicles and enhance the ownership experience.

Over ten years have passed since the introduction of Apple CarPlay and Android Auto, two smartphone-centric systems that rapidly gained widespread use partly because car manufacturers' entertainment interfaces were generally subpar back then. Beyond this, CarPlay and Android Auto simplified things by closely mirroring the intuitive user interfaces people were already accustomed to from their phones. Additionally, they utilize the mobile device’s cellular service for internet access, do not necessitate an extra fee, and automatically incorporate updates with new applications and functionalities as soon as they emerge.

Many car manufacturers quickly embraced the CarPlay/Android Auto trend, with even reluctant companies such as Toyota ultimately giving in due to their influence and widespread use. However, over the past few years, we've seen a move away from this integration. Electric vehicle-exclusive makers like Tesla and Rivian chose not to include CarPlay and Android Auto right from the start. In their newest electric vehicles, they have continued this approach. General Motors opted to follow suit. and intends to gradually reduce its reliance on these widely used platforms for upcoming vehicle models in preference for GM’s proprietary infotainment system and software .

The prime reason GM and other automakers have been moving away from CarPlay and Android Auto is simple: data. When you enter a navigation destination or select music or other content via CarPlay or Android Auto, the data those platforms gather primarily goes to the tech giants and not the car company. “They don't know how you are using their infotainment system,” said Andrew Hart, CEO of the analyst firm SBD. “That starves car companies, and they lose intelligence that could help them improve their offerings.”

Apple and Google gather significant information from individuals stuck inside vehicles with the intention of profiting from this data through multiple means. General Motors (GM), however, aims to secure such data primarily not to convert it directly into revenue like these technology behemoths—with GM and other automakers having largely fallen short when attempting this thus far—but instead to enhance their offerings and thereby satisfy and keep customers happy. "There is resistance emerging towards relinquishing control over usage data to major tech corporations," noted Hart. This strategy has the potential to create broader impacts should GM achieve success in implementing it.

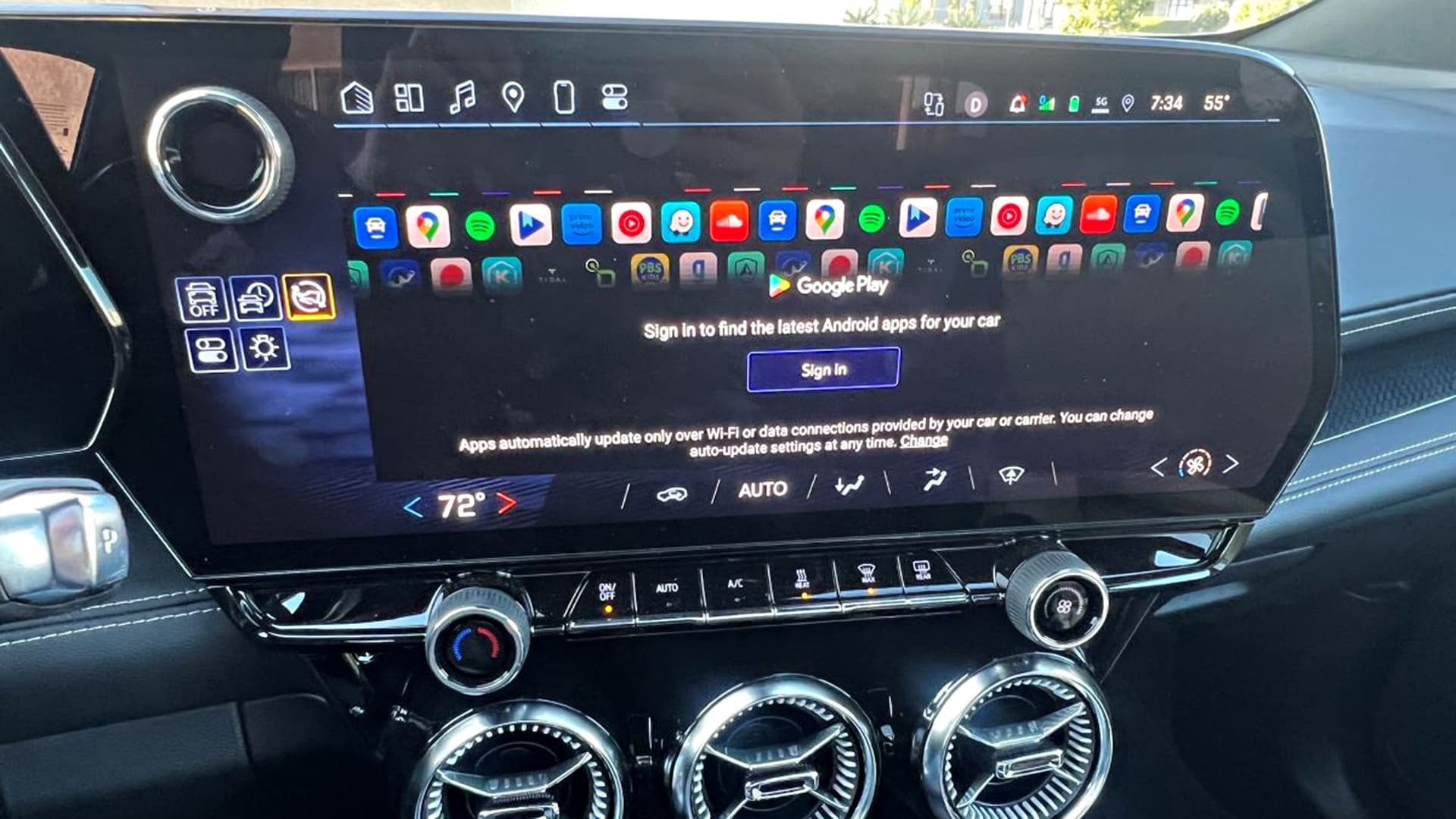

Exchanging Android Auto for Android Automotive

Although GM is discontinuing support for Android Auto, it is not cutting ties with Google; rather, it is collaborating with the technology company. a partnership that Volvo And others have similarly adopted it. The newest version of its infotainment system depends on Google's assistance. Android Automotive operating system This integration with Google apps like Maps enables users to log into their Google accounts for feature synchronization across multiple devices. Additionally, it comes equipped with Google Play, which facilitates the download and use of numerous applications.

In response to queries regarding the removal of Apple CarPlay and Android Auto, a General Motors representative stated through email: "We made an initial investment in developing our proprietary infotainment system because we believe that as technology advances, we will be able to provide functionalities surpassing those achievable solely through smartphone integration." One instance illustrating this approach is Dolby Atmos available on Amazon Music The newest addition to GM’s integrated infotainment system, offering "one of those awesome experiences you can only have without using your phone as an external display," according to GM.

Another feature is smart electric vehicle routing. When a driver inputs a destination, the system offers the optimal route considering real-time data like battery level, driving range, and accessible charging stations. Additionally, GM’s infotainment system includes this integration. Super Cruise automated hands-off highway cruising technology Using Google Maps to display specified Super Cruise routes and indicate the portion of the journey that can be managed without manual control. "Customers will experience ongoing improvements through software updates," GM stated further. "Our aim is to provide top-tier experiences for our customers by seamlessly combining hardware, software, and services."

GM’s Brave Move

Canceling Apple CarPlay Android Auto essentially involves a balance between consumer attraction and company control, as per Hart. He explained, "To provide an interface that users find familiar and pleasurable, car manufacturers must relinquish control over data and the overall system since both Apple and Google excel at crafting this kind of user experience." However, he added, "It takes courage for companies to ignore consumer input; yet, they now wish to avoid compromising between delivering an engaging experience and keeping hold of their own data."

Hart thinks General Motors is taking two simultaneous risks: first, assuming that CarPlay and Android Auto won't be as widely favored as commonly believed or shown by consumer research; second, believing they have the capability to create something just as good, if not superior, despite previous indications suggesting otherwise. "Manufacturers such as Rivian and Tesla Those without CarPlay have been capable of doing that," Hart stated. "However, for the majority, this has been an exception rather than the norm."

Rivian stood out as an exception by creating all its own software to harness data and enhance the ownership experience. "From the very beginning, we deliberately chose to develop all our electronic components internally and create the complete software stack that drives these electronics," he stated. Rivian's vice president of software development, Wassym Bensaid, Not just for infotainment purposes, this technology spans across the entire vehicle—from managing vehicle dynamics to optimizing energy usage and enhancing driver assistance systems. "Our focus is on delivering an exceptional customer experience primarily driven by software," Bensaid explained further. "Since all interactions within the car rely on software, collecting such data empowers us to constantly refine system performances."

Transitioning from Dollars to Data

Bensaid emphasized that unlike many automotive manufacturers, generating revenue through data collection wasn’t important for Rivian. "We've concentrated our efforts on developing a robust data infrastructure designed to enhance both the vehicle itself and the software driving user experiences," he explained. Hart noted that several auto industry players have shifted their strategies similarly, moving away from using data as a direct source of income towards improving overall customer satisfaction and enhancing product quality. He mentioned, "Around six or seven years back, there was significant excitement surrounding data monetization." During this period, numerous automobile firms established dedicated units aimed at capitalizing on collected data, often pursuing straightforward sales tactics like approaching insurance providers or retail businesses with offers centered around sharing valuable datasets.

However, there was backlash from customers and governmental authorities when the New York Times unveiled last year that GM’s OnStar Smart Driver app, advertised as an in-car driving tutor, was disclosing information to the insurance companies of the owners without their permission —resulting in significant increases in their insurance rates. GM swiftly terminated the Smart Driver program, and subsequently, the FTC prohibited the company from sharing consumers' sensitive location and driving activity information with consumer reporting agencies for half a decade.

Up until now, the straightforward financial worth of the data gathered hasn't met projections, largely due to most automobile manufacturers lacking the necessary technological skills to capitalize on it effectively like major technology firms do, as per Hart. Although the potential for profitability seems evident particularly within sectors such as insurance, GM’s experiences have made these expectations more realistic. Nonetheless, handling and utilizing this vast amount of collected information efficiently remains incredibly difficult.

Considering numerous concerns, initiatives related to data mining and revenue generation have mostly been deferred. According to Hart, "These efforts aren’t currently at the forefront of priorities, and there isn’t significant anticipation that data will become a major profit source." Instead, the focus has moved towards utilizing data internally to enhance processes, boost efficiency, refine warranties, and upgrade customer support—domains where they believe benefits would be more immediate and measurable.

Apple and Google Aim for a More Detached Approach

Although the automobile industry constitutes only a minor part of Apple and Google’s extensive operations, it still holds significant importance for these technology powerhouses. Despite facing continuous difficulties collaborating with automakers and their suppliers, as well as dealing with the increasing trend moving away from CarPlay and Android Auto, both companies persist in this endeavor. "Apple prefers to adopt a more laid-back approach by providing an SDK and simply instructing them accordingly," explained Hart. However, auto manufacturers are accustomed to engaging differently when partnering with vendors."

It’s one of the reasons why Apple CarPlay 2.0, unveiled nearly three years ago, has yet to make an appearance in any production car. According to Hart, "The process has been lengthier due to the intricate challenges and extended development timelines inherent in the auto industry, along with their distinctive blended strategy for CarPlay 2.0." Apple learned from experience just how challenging—and costly—it is to manufacture vehicles, leading them to abandon that path eventually. cancelling its car development initiative known as Project Titan As a consequence, Hart believes that Apple won't fully withdraw from the automotive sector. "Given how crucial cars are, with so much time spent by their customers inside vehicles, they wouldn't simply surrender entirely and watch their CarPlay usage decline," Hart explained.

In the meantime, Google has diversified its interests in the automotive sector via its autonomous driving unit, Waymo, along with its Android Automotive OS and associated applications. These offerings have gained traction with multiple car manufacturers such as GM, BMW, Ford, Honda, Nissan, and even Volvo—a company closely linked to Google’s innovations. As Hart pointed out, "The time people spend in vehicles won't diminish significantly, making it crucial for Google to maintain a robust presence in this area."

Even though the final say on who gains access to all this data and how it will be shared among tech companies and car manufacturers remains unresolved (some collaboration does occur currently, as Hart points out), General Motors has begun taking a firm stance. Recently, the company prohibited its dealerships from fitting their electric vehicles with aftermarket Apple CarPlay upgrade kits, claiming that these could compromise essential safety functions within the cars.

No matter how things turn out among them, one fact remains clear: Every car owner needs to pay attention to how the data they generate while driving their vehicles is utilized—and this concern applies both presently and going forward.

romero.my.id

Posting Komentar

Posting Komentar