- Cadillac aims to reclaim its status as the top American luxury car marque.

- This is an essential marketplace for car manufacturers such as GM because luxury cars boast higher profit margins compared to standard models and appeal to a wealthier clientele.

- This is how the company aims to revamp its lineup and enhance its standing within the cutthroat luxury car sector.

WARREN, Mich. — Entering General Motors' global design headquarters feels akin to traveling back in history. The majority of the mid-century modern architectural elements and designs within the facility remain largely unchanged from when they were first established in the 1950s.

The expansive design and technology campus was constructed during an era when the Detroit car company dominated the industry. This period is often referred to as GM’s heyday, marked by its high-end Cadillac division setting the benchmark as “the standard of the world” — prior to experiencing significant losses in U.S. market share over several years due to heightened rivalry from brands like BMW, Mercedes-Benz, Lexus, among others.

GM President Mark Reuss was not around during that time period, yet he has looked back at it as he and his team have meticulously led a resurgence in Cadillac’s product lineup, aiming to restore the brand’s former status and significance. the American luxury brand.

"In terms of American luxury brands, there aren’t many out there. It’s true, I believe it’s high time—and this is something I feel very strongly about—for General Motors and Cadillac to demonstrate to the global market what they are capable of,” Reuss stated to romero.my.id from his second-floor office near the entrance.

Historically, Cadillac’s main rival domestically has been Ford Motor Company’s Lincoln luxury division, which sells approximately one-third fewer cars than its General Motors counterpart in the U.S. Additionally, European marques like those from Germany along with Japanese automakers have joined this competitive landscape over time. More recently, South Korean manufacturers have also become part of it. Furthermore, all-electric vehicle makers such as Tesla and Lucid Group add their own dynamic to this rivalry.

The high-end car segment is vital for manufacturers. These automobiles boast greater profit margins compared to standard models and appeal to wealthier consumers who see them not just as means of transport but also as symbols of prestige.

As the president, Reuss oversees all of the automaker’s products and brands. However, he has consistently shown particular attention to Cadillac, a division that has had four leaders since 2015.

Individuals associated with the brand characterize Reuss as a guardian, advocate, and even spiritual guide of sorts for Cadillac.

Although things haven’t always gone exactly according to plan—such as challenges with sales in China and the production and uptake of electric vehicles—Cadillac has mostly adhered to a strategy implemented ten years ago aimed at strengthening the luxury division. This achievement isn’t simple considering the uncertainties brought about by regulation changes and budget reductions within General Motors, which is one massive automotive corporation.

“If you had examined Cadillac’s finances and product lineup, it wasn’t performing well,” Reuss stated. “Transforming this 150-year-old brand from its previous state, which was far from robust, has been quite an endeavor. The phrase ‘standard of the world’ didn’t apply then, doesn’t now either. However, we still have improvements to make; yet our vision remains distinct and unwavering.”

This strategy primarily depends on fully electric cars, sleek sedans, and the brand’s iconic Escalade — one of GM’s oldest and most recognizable models — to restore Cadillac’s reputation.

Cadillac executives characterize it as a race with an ever-lasting finishing line.

Resurrecting Cadillac

During the summer of 2018, Reuss, who headed GM’s design team along with Michael Simcoe, and Steve Carlisle, previously leading Cadillac, alongside several others, outlined their vision for Cadillac before presenting it more broadly within GM during a session held at the company's famous design center. This initiative essentially reassessed an earlier strategy formulated for Cadillac back in 2015.

The overarching plan aimed at mostly segregating Cadillac’s offerings from those of General Motors’ other divisions, prohibiting the sharing of customer-oriented components. While they would still share certain chassis, engines, and powertrain elements, the interior designs as well as specific engine types were intended to remain exclusive to Cadillac.

"In terms of defining what the brand might become, we aimed to set some foundational elements,” Carlisle mentioned in a telephone conversation. “ numerous attempts were made, but mostly they did not succeed.”

The objective was to revitalize Cadillac’s lineup with dynamic and stylish models that would enhance the brand’s prestige, consequently boosting the resale value of their cars. Additionally, the company aimed to reduce promotional discounts.

Around that period, Reuss characterized it as Cadillac’s “single opportunity,” stating that the Detroit-based company would “hold back nothing.”

According to executives, automotive analysts, and industry statistics, Cadillac has mostly managed to set things right concerning these goals.

At present, I believe they are in excellent condition," stated Stephanie Brinley, lead automotive analyst at S&P Global Mobility. "They've maintained a steady approach towards managing the Cadillac brand, which will remain crucial… sustaining this consistency over an extended period is among the most vital factors.

Cadillac has opted to concentrate its upcoming product line exclusively on electric vehicles in an effort to rival Tesla’s expensive Model Y and Model X offerings. Initially planning for Cadillac EVs to replace gasoline models by 2030, they have since revised their strategy to include both fully electric and gas-powered vehicle options.

The initial product launched as part of the new strategy was the fully electric vehicle. Lyriq that became available for purchase in 2022, however, the peak of the strategy is the bespoke, $300,000 Celestiq that the brand is now being "reintroduced."

The exhibition held at the design dome in 2018—a sacred space for the car company—was vital in promoting Cadillac’s contemporary vision, as stated by Simcoe, Carlisle, and other participants involved.

Inside the dome, Simcoe shared with romero.my.id from his perch in the corner design studio that they had envisioned everything about Celestiq and what defines Cadillac as a brand," he said. "All these elements were meant to encapsulate the essence of the company.

Simcoe mentioned that there was a vision for the target audience, a plan for the required product lineup, and essentially an outlook for nearly every aspect within the company.

The dome presentation occurred following the departure of Cadillac’s final president, Johan de Nysschen (since then, all top executives at Cadillac have held the position of vice president). De Nysschen had previously emphasized the importance of the brand developing its exclusive vehicle architectures and engine systems. .

Nysschen, an automotive industry veteran known for leading both Audi and Infiniti, mentioned that he thinks Cadillac "has come quite far" since he left. He stated, "It pleases me to see that broadly speaking, they have adhered to the strategic path we jointly developed with GM’s senior leadership." This was shared during a telephone conversation.

Value over volume

General Motors' general guideline has been to focus on "quantity rather than quality," encompassing attaining widespread production for popular models before manufacturing premium cars like Cadillacs.

This approach has boosted General Motors' earnings, yet it has posed difficulties for Cadillac occasionally. This has led the brand to lag behind in certain vehicle categories and has manifested in products like the now-defunct Cadillac ELR (based on the Chevrolet Volt) about ten years ago, along with the more recent example. outgoing XT6 crossover.

Cadillac has shifted its focus, according to officials.

For instance, there was anticipation that GM might create a Cadillac variant of the mid-engine Corvette. However, Reuss stated that this type of vehicle wouldn’t align with the brand’s updated strategy, emphasizing that it would predominantly share parts with the Corvette.

“It was created intentionally as a supplementary model to the Corvette,” Reuss stated, emphasizing that they have no plans to go down that route again. He also mentioned the possibility of introducing more specialized Cadillacs beyond their high-end Celestiq, which starts at over $300,000.

The fully electric Celestiq is a custom car being crafted individually at the company’s technology and design center in Warren. Despite being intended for limited-production from the start, orders as of the previous year-end totaled just a few dozen units.

Following postponed beginnings of both production and sales, Reuss stated that GM is basically restarting the launch of the vehicle once the automaker had sorted out its software, which is a critical aspect of their operations.

"Let’s be completely upfront; we faced challenges when initially rolling out our standard electric vehicles,” Reuss stated. “So, we’ve developed our software capabilities to ensure smooth and timely execution. We were adamant about not releasing the vehicle until every aspect of the software was flawless. ... Honestly, this means we’re essentially reintroducing the car.”

The first customer deliveries of the Celestiq are anticipated by mid-year, as stated by the company, but they have not disclosed the number of orders received for the vehicle.

If achieved, this breakthrough could establish a fresh dual-business strategy for the corporation: one division dedicated to meticulously crafted luxury cars and another geared towards producing large volumes of standard models.

Challenges remain

Wall Street is beginning to pay attention to Cadillac within GM's operations again, since other expansion prospects have weakened.

"One of the true hidden treasures is Cadillac, which we believe doesn’t receive sufficient coverage, and this presents substantial potential," stated BofA’s analyst John Murphy during an investor conference last month alongside Cadillac’s present head, John Roth.

Cadillac’s long-term strategy over ten years is gaining traction, especially within North America, which remains its primary market.

In the initial three months of this year, Cadillac saw an 18% rise in sales figures, which included their strongest retail showing since 2008, according to Roth. This was achieved even though they provided some of the least substantial discounts relative to sale price on historical record, with typical vehicle transactions averaging at around $77,900.

Creating brand health and enhancing brand value is what we're doing," stated Roth, the global vice president of Cadillac, during the BofA conference. "It’s a growing brand.

In April, the brand achieved its highest sales figures for that month since 2007, according to GM CEO. Mary Barra mentioned during a conference call on Thursday. She pointed out that almost all of Cadillac’s vehicles are manufactured in the USA — giving them an edge over German luxury marques and competitors.

"There’s a significant chance for us to keep building upon and utilizing our product strengths along with the advantage of having these vehicles manufactured in the U.S.," Barra stated.

Reuss refused to discuss the possible effects on Cadillac due to tariffs. However, he stated that the U.S. brand is in a strong position to keep growing.

As Cadillac expands within domestic markets, the brand’s sales in China—the top market for Cadillac for several years up till 2024—have plummeted sharply. This issue isn’t exclusive to Cadillac; it affects the entire industry, with local Chinese manufacturers gaining prominence and outperforming Western competitors like Cadillac, BMW, and more.

Operating in China poses challenges for everybody. While Cadillac can influence some aspects of addressing these issues, certain factors remain beyond their control," Brinley stated. "The quality of their offerings is solid, yet current market conditions in China aren’t particularly advantageous for foreign brands at this moment.

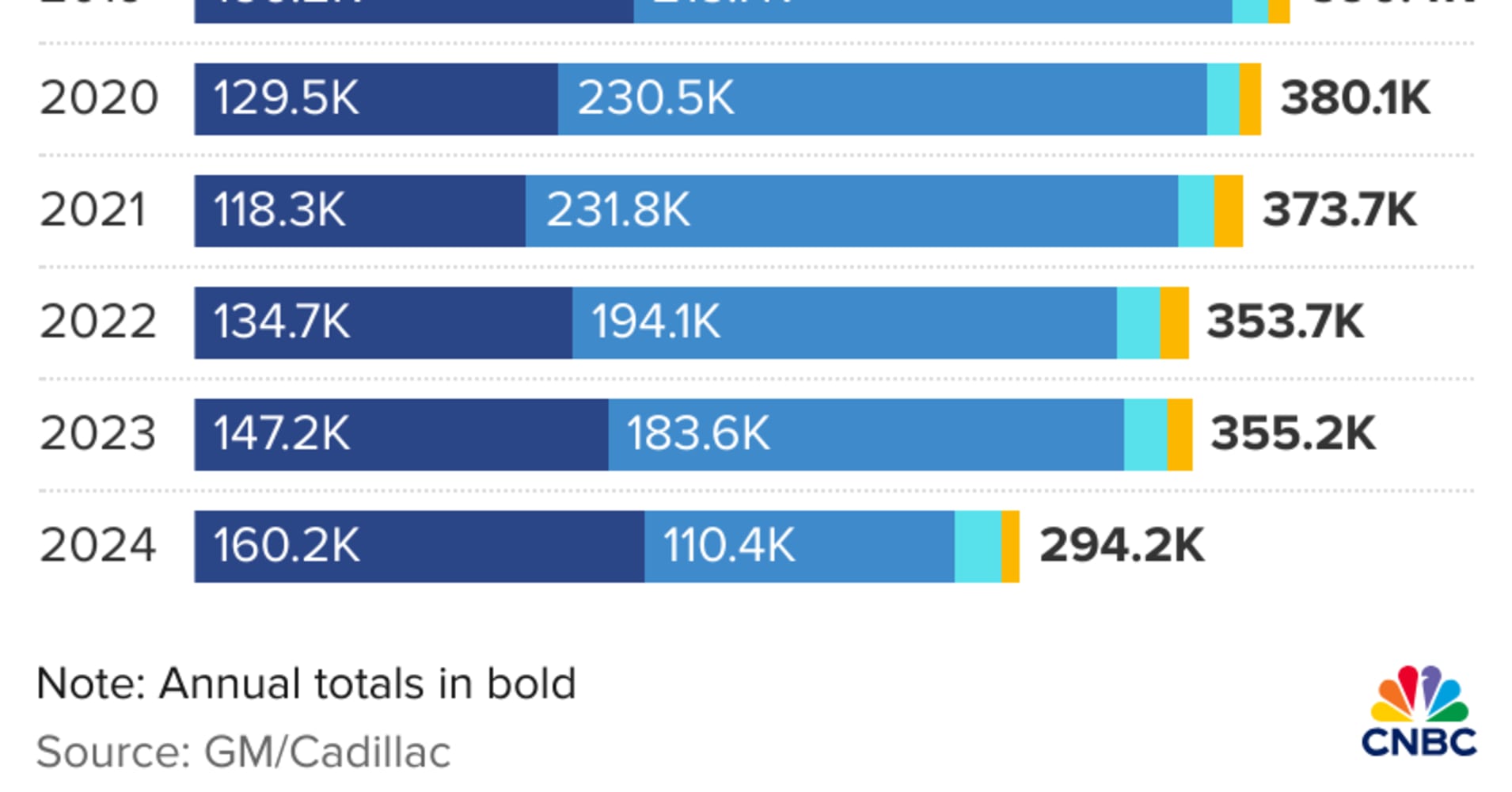

In 2021, Cadillac’s sales in China reached almost 232,000 vehicles, accounting for about 62% of their total global sales. However, by 2024, sales in China fell to approximately 110,400 units, constituting around 38% of the brand's overall global sales of 294,200—this being the first instance since 2015 where annual sales dipped under 300,000 worldwide.

Reuss, who serves as GM’s president, stated that China continues to be a priority for the company. Additionally, General Motors is striving to reintroduce Cadillac into the European market, from which it withdrew following the sale of its European operations in 2017.

Reuss refused to comment on Cadillac's sales objectives, however, he mentioned that both China and Europe still hold significant positions in driving the brand’s resurgence.

"I believe our approach to global vehicle execution will evolve, however, Cadillac will continue to offer cutting-edge models. We also need to strengthen our sales capabilities, which is currently underway," stated Reuss.

Last year, Cadillac failed to secure a spot on the winners' platform regarding sales figures. In the United States, it ranked fifth, and globally, it placed seventh, based on industry statistics verified by Cadillac itself. The brand lagged behind top global leaders such as BMW, followed by competitors like Mercedes-Benz and Audi.

Last month, Roth mentioned that the brand's achievements encompass sales figures; however, Cadillac’s objectives extend beyond this, as their aim to profitably expand the Cadillac marque persists.

"As Mr. Roth informed the investors earlier this month, he said Cadillac sets the ‘world standard.’" He continued, “This benchmark doesn’t have an endpoint; we continually shift our goals higher. The objective remains elevating the essence of the brand within the market arena and persistently advancing and transforming the brand with future-oriented development.”

Posting Komentar

Posting Komentar